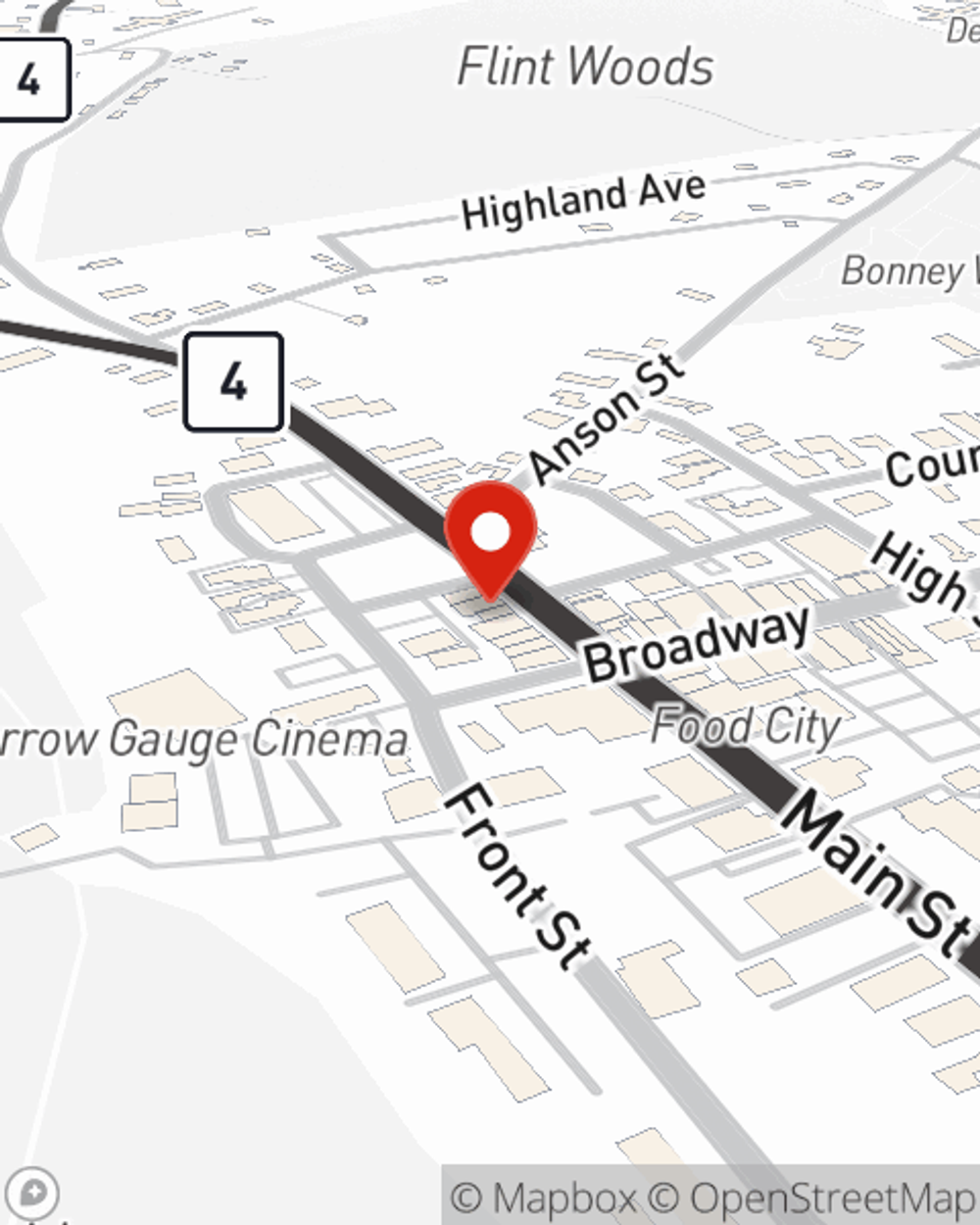

Business Insurance in and around Farmington

Get your Farmington business covered, right here!

Insure your business, intentionally

- Farmington

- LIVERMORE FALLS

- KINGFIELD

- RANGELEY

- BELGRADE LAKES

- WILTON

- JAY

- STRONG

- PORTLAND

- STATE OF MAINE

- NEW HAMPSHIRE

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of challenges. You shouldn't have to face those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, extra liability coverage and errors and omissions liability, among others.

Get your Farmington business covered, right here!

Insure your business, intentionally

Strictly Business With State Farm

At State Farm, apply for the excellent coverage you may need for your business, whether it's a farm supply store, a clock shop or a veterinarian. Agent Susan Terhune is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Contact agent Susan Terhune to discuss your small business coverage options today.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Susan Terhune

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.